25+ long straddle calculator

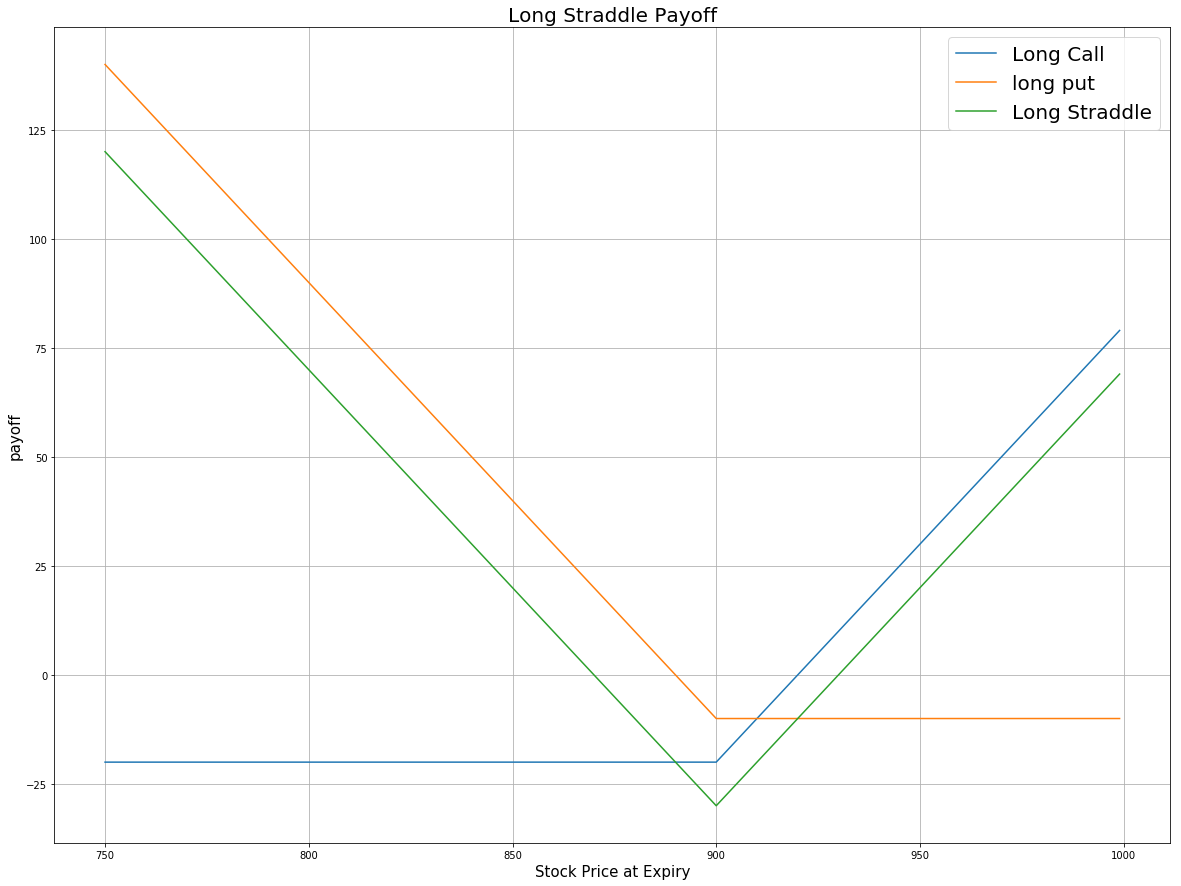

Find the best long straddle options with a. Web The Long Straddle is an options strategy involving the purchase of a Call and a Put option with the same strike.

Long Straddle

Web Long Straddle.

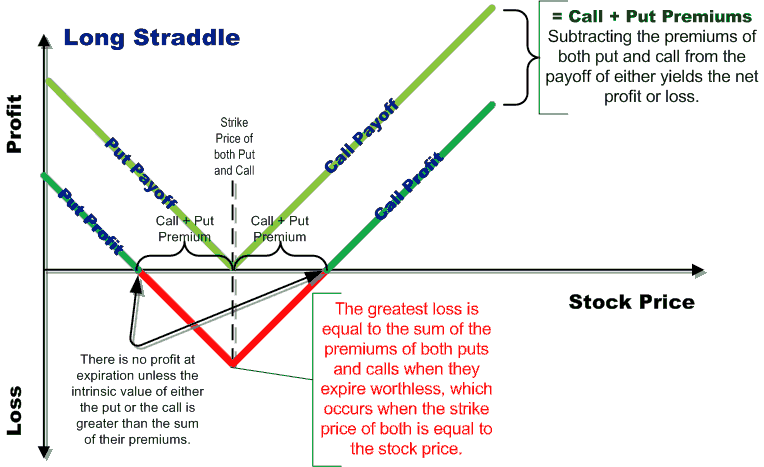

. Web Remember the cost of a long straddle represents the combined premium required to buy both call and put options. Web A long straddle consists of a long call and long put where both options have the same expiration and identical strike prices. Initial cost put cost call cost In our example.

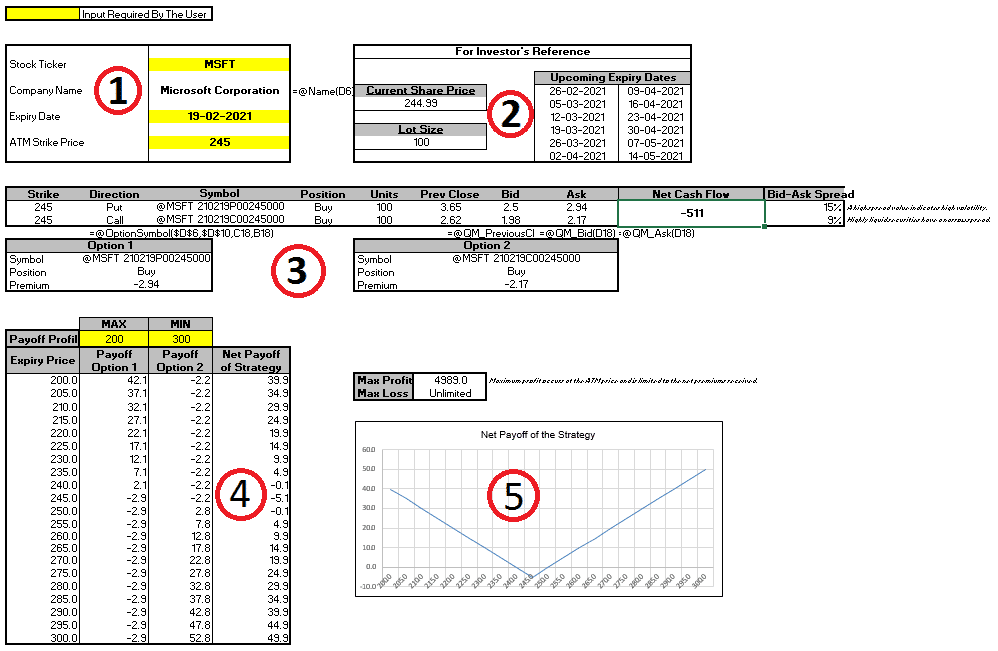

In the case of a. Web Short and Long Straddle in Excel for Dummies. Initial cost 285 288 573.

Enter the maturity in days of the. Upper Breakeven Price Strike Price of the Long Straddle Net. It really helps when Im confused and explains the steps and the layout is really easy to work with makes math.

Web The long straddle is simply a long call and a long put purchased at the same strike price for the same expiration date. So at 15 volatility it costs Rs160 to set up the. For example if a stock is trading at 100.

Web In order to breakeven on a long straddle the stock price must increase or decrease beyond the strike price in either direction enough to recover the premium paid. Enter the underlying asset price and risk free rate Step 3. Web Thanks for this app i am a 45 year old that went back to college.

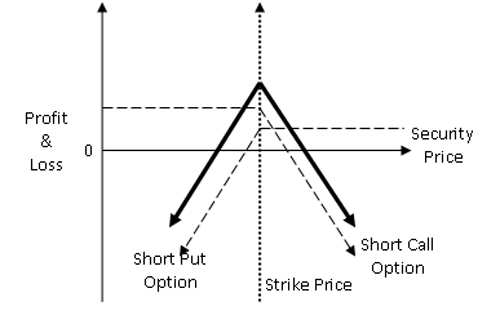

Just add up the money paid for the two legs. An investor is buying a Call with a higher. 8438 views Dec 30 2019 125 Dislike Share Option Trader 51K subscribers A straddle is a neutral options strategy that.

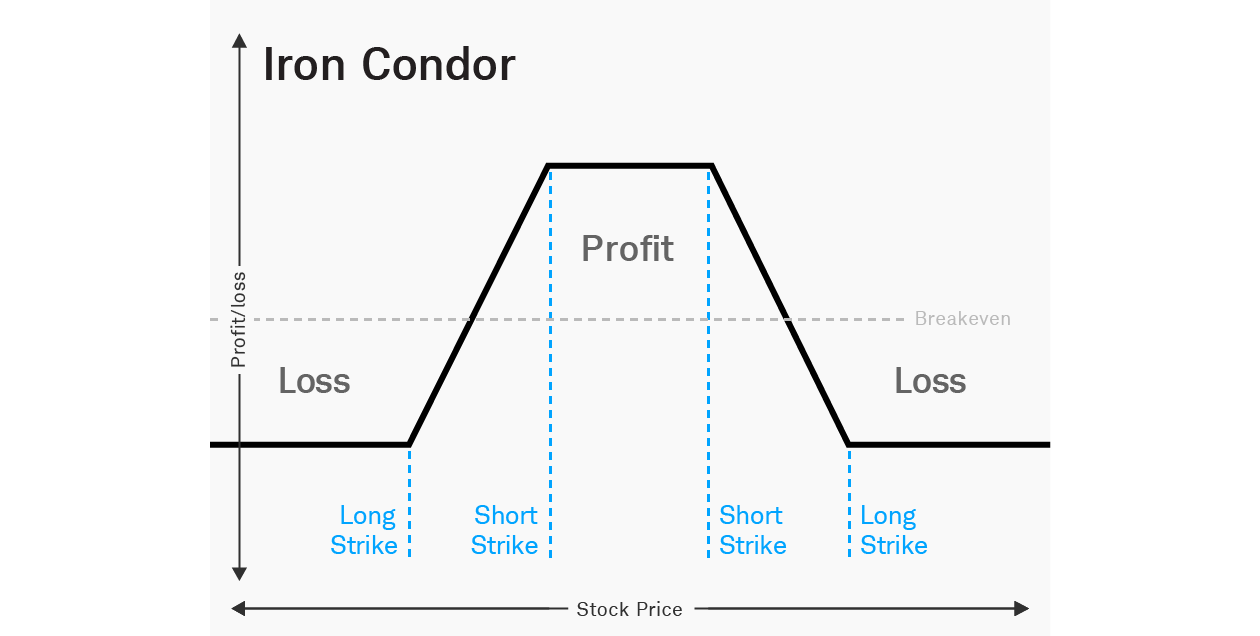

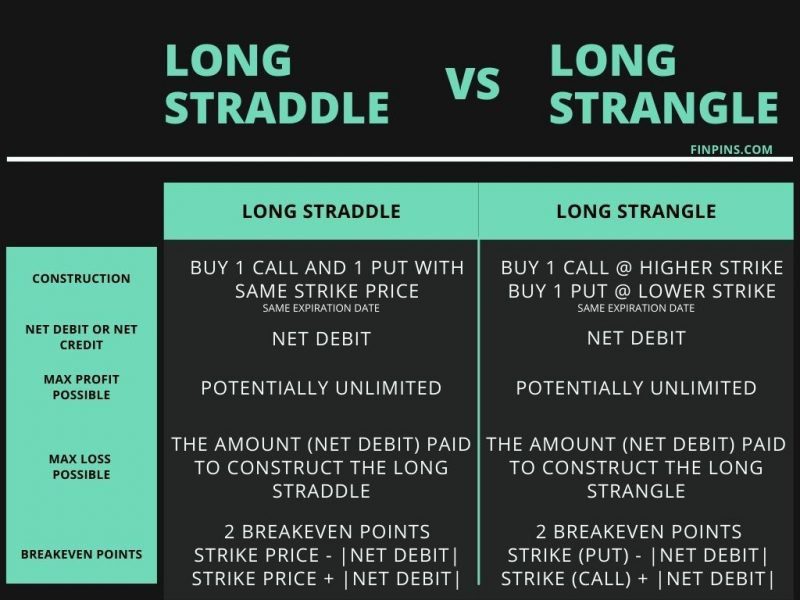

Investors who are expecting. Web Multiplication calculator shows steps so you can see long multiplication work. Web The Long Strangle is an options strategy resembling the Long Straddle the only difference being that the strike of the options are different.

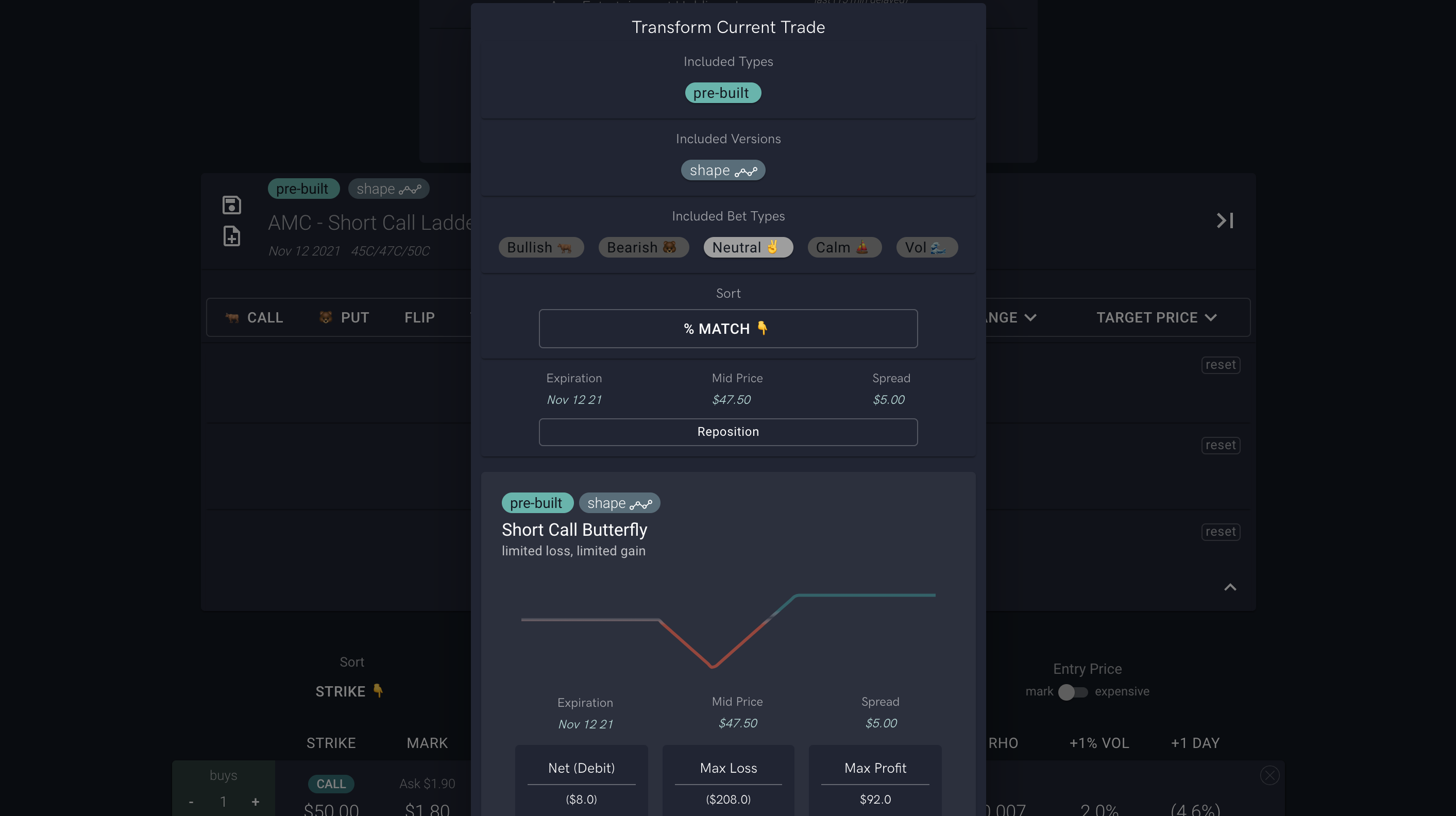

Web A long straddle is a combination of buying a call and buying a put both with the same strike price and expiration. Select your option strategy type Long Straddle or Short Straddle Step 2. Together they produce a position that should profit if the stock.

If the earnings call goes well and the stocks price rises to 5625 each call option might now have a value of 675 giving the. Web A long straddle is the best of both worlds since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. Web A long straddle has two breakeven prices which can be found by applying the following formulas.

Web Initial cost of the position is very easy to calculate. The strategy generates a profit if the stock price rises or drops. Web A long straddle is buying a call and a put with the same underlying stock the same strike price and the same expiration month.

Enter multiplicand and multiplier of positive or negative numbers or decimal numbers to get the.

Straddle Strategy Types Examples How It Works

Straddle Latest Straddle News Designation Education Net Worth Assets The Economic Times

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Straddle_Strategy_For_Market_Profits_Jun_2020-02-4f0d46de5d5e4635a47a80a752626d6e.jpg)

Understanding A Straddle Strategy For Market Profits

Options Profit Calculator Opc

What Is A Long Straddle The Motley Fool

Straddle Options Trading Strategy Using Python

Option Strategy In Tamil Long Straddle Option Strategy Options Strategies In Tamil Youtube

Options Straddle Strategies Earnings Announcements Ticker Tape

Options Straddles Vs Strangles The Basics Of Volati Ticker Tape

Option Strategies Long Straddle Excel Template Marketxls

Straddles Cme Group

Short And Long Straddle In Excel For Dummies Youtube

Long Straddle Volatile Options Trading Strategy Suitable For Beginners

Straddle Vs Strangle Options Explained In 5 Minutes

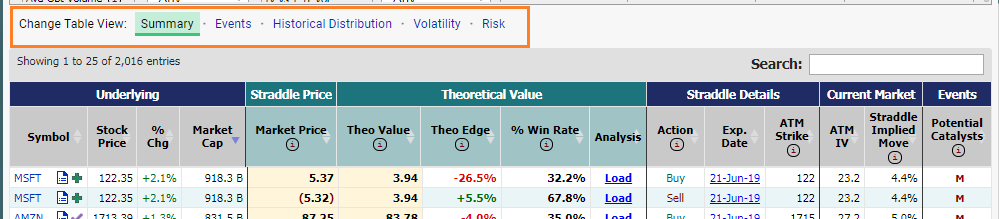

Long Straddle Screener Results For February 15th

At The Money Straddle Screener Learn Options Trading

Long Straddle Understanding One Of The Most Popular Options Trading Strategies Delta Exchange